Fulfilling the digital transformation priority of digital business at scale.

Digital Business is Superseded by Digital Business at Scale

When enterprises began their digital journey, their primary focus was to make business operations more responsive by leveraging digitally connected products, assets, people and partners. Recently, this has grown into a realization and appreciation for the need to scale digital operations to deliver hyper-personalized and cost effective digital services.

Recently work at Emirates NBD and a large private bank in Asia around blockchain demonstrates how emerging technologies have the power scale digital operations.

- The two organizations recently partnered with Infosys Finacle to pilot 2 use cases on the EdgeVerve Blockchain Framework -Trade Finance and remittance

- In the trade finance pilot, they addressed the problems associated with an open account transaction. An open account transaction is a sale where the goods are shipped and delivered before payment is due. The open account process is cumbersome and often involves a lot of effort and risk for a bank. The process often results in duplicate payments, minimal validations, and physical document handling because there is:

- Difficulty of enforcing contracts.

- Difficulty for importers and banks to comply with foreign currency documentation requirements.

- The link between banks to buyers and sellers is often missing or broken

The pilot centered around confirmation that a Mumbai-based export-import firm received a shipment of shredded steel melting scrap from a Dubai-based supplier. The transaction involved two banks – Emirates NBD and the large bank in Asia, a Mumbai-based importer and a Dubai-based exporter.

By running the transaction over EdgeVerve’s blockchain application they were able to execute a trade finance transaction through a series of encrypted and secure digital contracts.

Fulfilling the digital transformation priority of digital business at scale.

The blockchain technology eliminated physical movement of documents and completely automated the process. It also enabled all the parties to track documentation and authenticate ownership of assets in real time.

Remittances pilot: They also conducted a pilot around remittances to establish the feasibility of performing direct remittance over the blockchain network.

When enterprises began their digital journey, their primary focus was to make business operations more responsive by leveraging digitally connected products, assets, people and partners. Recently, this has grown into a realization and appreciation for the need to scale digital operations to deliver hyper-personalized and cost effective digital services.Meredith Whalen, Senior Vice President, IT Executive, Software, Services, Industry and Customer Insights Research, IDC

Currently, international remittances can take up to a few hours or even two days. By involving the transaction on EdgeVerve’s blockchain application, the bank in Asia was able to remit funds to Emirates NDB branch in Dubai in real time.

Emirates NBD along with their partner will take the international remittances pilot to production, soon. They want to include more peers, regulators, exchange houses, on this network, so as to realize the true potential of blockchain.

Fulfilling the digital transformation priority of digital business at scale.

Blockchain technology has the potential to transform banking as we know it by lowering costs, improving transaction security, speeding up post-trade settlements, and improving liquidity – all of which allow a business to scale its digital business.

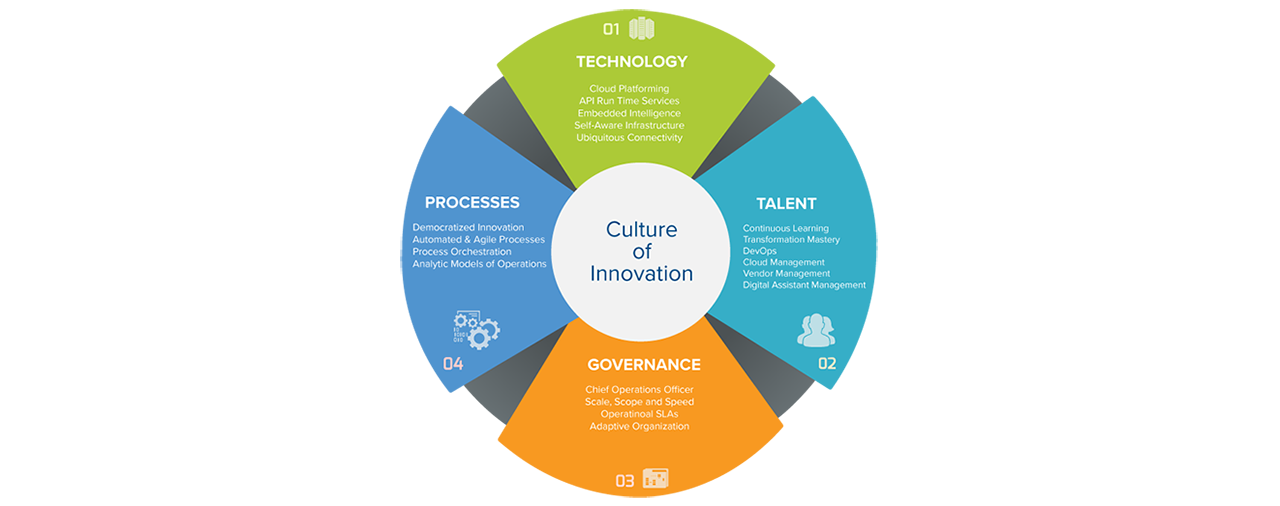

New IT Capabilities Required for Digital Business at Scale

Running a digital enterprise at scale requires a new set of IT capabilities.

- Scale – A set of processes, governance and platforms that allow your systems to be self-organizing, self-healing and self-optimized. It requires analytics models of operations to do scenarios planning; and embedded intelligence in your platforms that allows your infrastructure to be self-aware

- Scope – Achieving scale across the scope of the entire enterprise requires much governance and a COO role to ensure orchestration happens across all the processes.

- Speed – To achieve speed in the organization, it not only requires speed in innovation; but also the ability to rapidly incorporate new learnings. Cloud platforms allow for rapid access to new technologies. And your vendor management skills need to adapt to measure vendors on their ability to help you rapidly drive change in your organization.